I am always interested in how money moves, especially in the tech ecosystem. My interest (and that of many of my peers) was piqued yesterday when Wiz decided to turn down a $23B offer from Google.

To date, the most interesting piece I’ve read about this whole dance is Sophie Shulman’s article for CTech, “From IPO dreams to CrowdStrike’s crisis: Inside the collapse of the Wiz-Google mega deal”.

These are my takeaways.

Wiz players and context to consider

- The Company: Wiz is an Israeli cybersecurity company with ~1,200 employees and an ARR of $500M

- The Founders: Are ~40 years old and are all independently wealthy already. This likely informs how they think about acquisition offers

- They sold Adallom to Microsoft for $320M in 2015 (also, wowzer, two mega-successful companies in a relatively short time period!) – they don’t need money

- At ~40 years old, they’ve got plenty career time to time left to swing big; it sounds like the founders want to take a big swing and go public

- They see a company like Palo Alto Networks (market cap >$100B) as inspiration

- Long term, there is also likely some pride in being a massive Israeli success story, and a desire to keep that going as an independent company. On the flip side, the Israeli treasury might benefit from a cash infusion today to cover war deficits – All of Wiz’s IP is registered in the US

- The Early Investors: Have presumably already made many multiples of their initial investment, and Wiz has grown exponentially since its founding in 2020 - these gains are all unrealized

- 🤑👏 $0 to $500M ARR from Jan 2020 to today… that’s impressive!

- The original investors are some big names in the world of VC: Doug Leone from Sequoia, Shardul Shah from Index, Jeff Horing from Insight, Gili Raanan and (since last year) Emily Heath representing the Israeli Cyberstarts fund

- Andreessen Horowitz invested at a fundraising value of $12B… so they’d probably like to make their money back

How about those numbers?

- 🤯 Wiz has an ARR of $500M… which means Google’s $23B offer was at a 46x multiple, which seems wild in the current markets

- Revenue multipliers for other comps: 13x for Palo Alto, 16x for Crowdstrike

- Even before last week’s Crowdstrike debacle (which hurt their multiplier quite a bit), Crowdstrike “a darling of cyber investors” was trading at a multiple of 20x on its expected revenue of $4B

- Crowdstrike’s fiasco in the final days of a possible Google<>Wiz deal likely helped Wiz: it highlighted the importance of the ecosystem and the lack of options in the space

Musings on Employee ownership

- It sounds like the four founders each own 10% of the company and the employees own significantly less. This isn’t unusual, the magnitude of difference is interesting

- Quote: “after distributing the spoils to all the investors and paying the taxes, [each employee] would have been left with amounts of hundreds of thousands of shekels from the deal. Although these are not small amounts, they are not considered life-changing either”

- Again, this isn’t shocking, it is the kind of math worth reflecting upon when contemplating offer letters and options grants

What’s next for Wiz?

- Not another high stakes game of “want to buy me?” unless it actually ends in an acquisition – otherwise they’re flirting with potential reputation and credibility issues

- Wiz has a history of using leaks to create the impression it’s bigger than it is – not dissimilar from this leaked deal

- There’s speculation around the 11th hour timing of this deal’s termination. The acquisition offer was turned down at the last possible minute: in a 7pm PT Tuesday email… which was an interesting choice for an Israeli-based company (5am IST Wednesday) whose decision would impact US financial markets (10pm ET)

- Presumably, Wiz is now shooting for an IPO

- They might be gunning for a higher offer from Google, or even Microsoft or Amazon

- But if they want to IPO they’re going to need to hit some major milestones:

- Sales rate of at least $1B

- Much higher levels of corporate governance, including: a CFO, an organized board

- Given that Crowdstrike was, until last week, trading at a notably-high-for-the-current-markets multiple of 20x, a $1B sales rate would put Wiz’s IPO valuation at $20B. Which is, yes, less than $23B

- For reference, in the frothy IPO markets of the 2020/2021 era, a select few companies like Snowflake (stock price trajectory shown below) shot up to something like a 150x revenue multiple. Snowflake currently trades at ~20x

- A multiple of ~15x would be fairly favorable in today’s markets

- Will the 2025 and 2026 markets support such a high multiplier? Unlikely, but who knows – 2 years is a long time in tech

✨ Bonus: Back of the napkin valuations for your own SaaS company

There is a story behind every valuation. It is quite a simplification to say valuation = multiplier * ARR, but it’s a useful simplification so let’s stick to that for now.

Multiples are informed by many factors including profitability and rate of growth (i.e. if a company is doubling its revenue year-over-year, it will grow into a higher valuation more quickly and could command a higher multiple as a result).

For this extremely back of the napkin don’t come for me math, you’re going to need two things:

- Your industry’s multiplier.

- Your company’s ARR.

Pick a multiplier

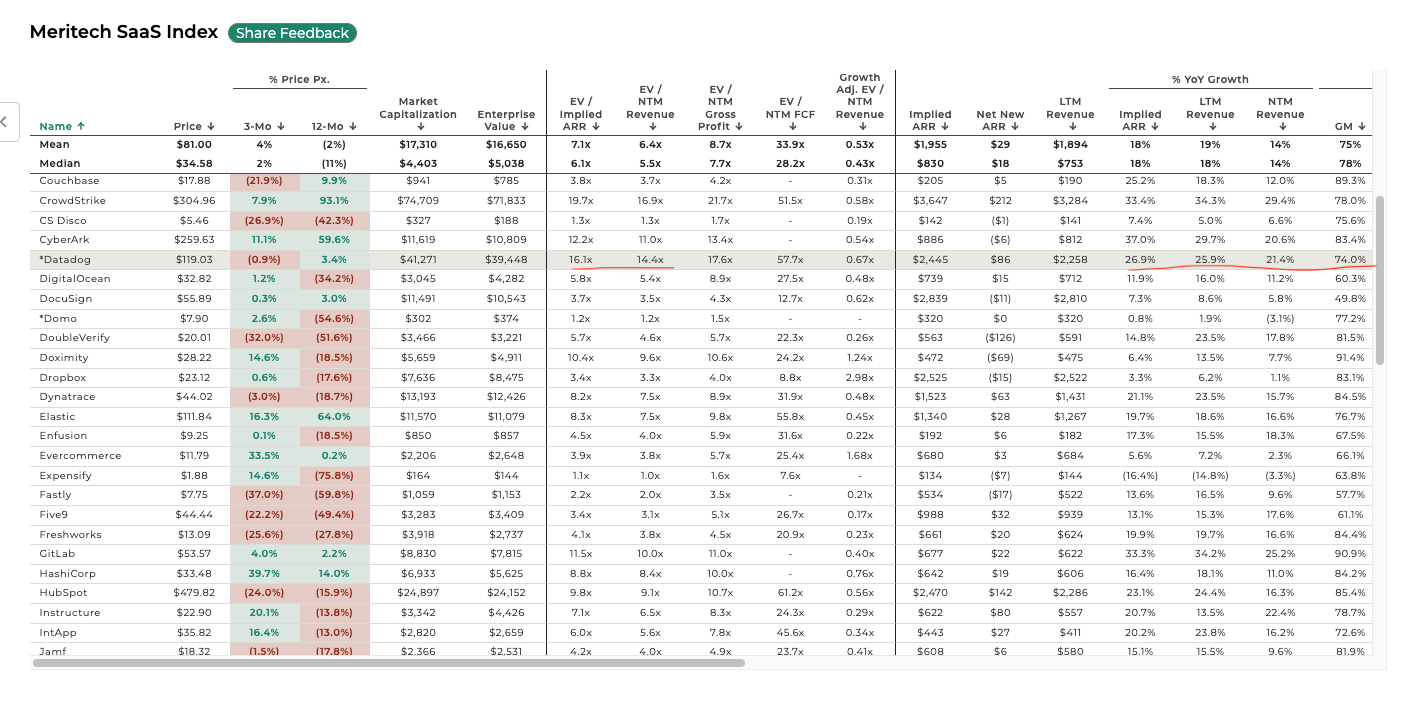

In order to approximate a multiplier for your company, first identify a public company in a similar space and then reach for Meritech’s excellent comps information.

Once you’ve identified a comparable company, put on your thinking cap and consider how your current company is similar to and different from your chosen comp. The closer your company is to the comp, the more likely it would be to command a similar multiplier from the market at large.

For example: I work at Honeycomb.io (which I highly recommend and we’re hiring!!). Given that we are an observability tooling company, I look at Datadog’s information as a possible proxy rather than, say, Shopify’s.

Things to note in Datadog’s numbers:

- Their

EV / Implied ARRandEV / NTM Revenueare 16.1x and 14.4x, respectively. So a ~15x multiplier seems reasonable- Those numbers are noticeably higher than those of peers in the SaaS ecosystem… so it would be reasonable to temper expectations and assume that Datadog’s numbers are aspirational

- Their

% YoY Growthnumbers indicate ~25% YoY growth - Their

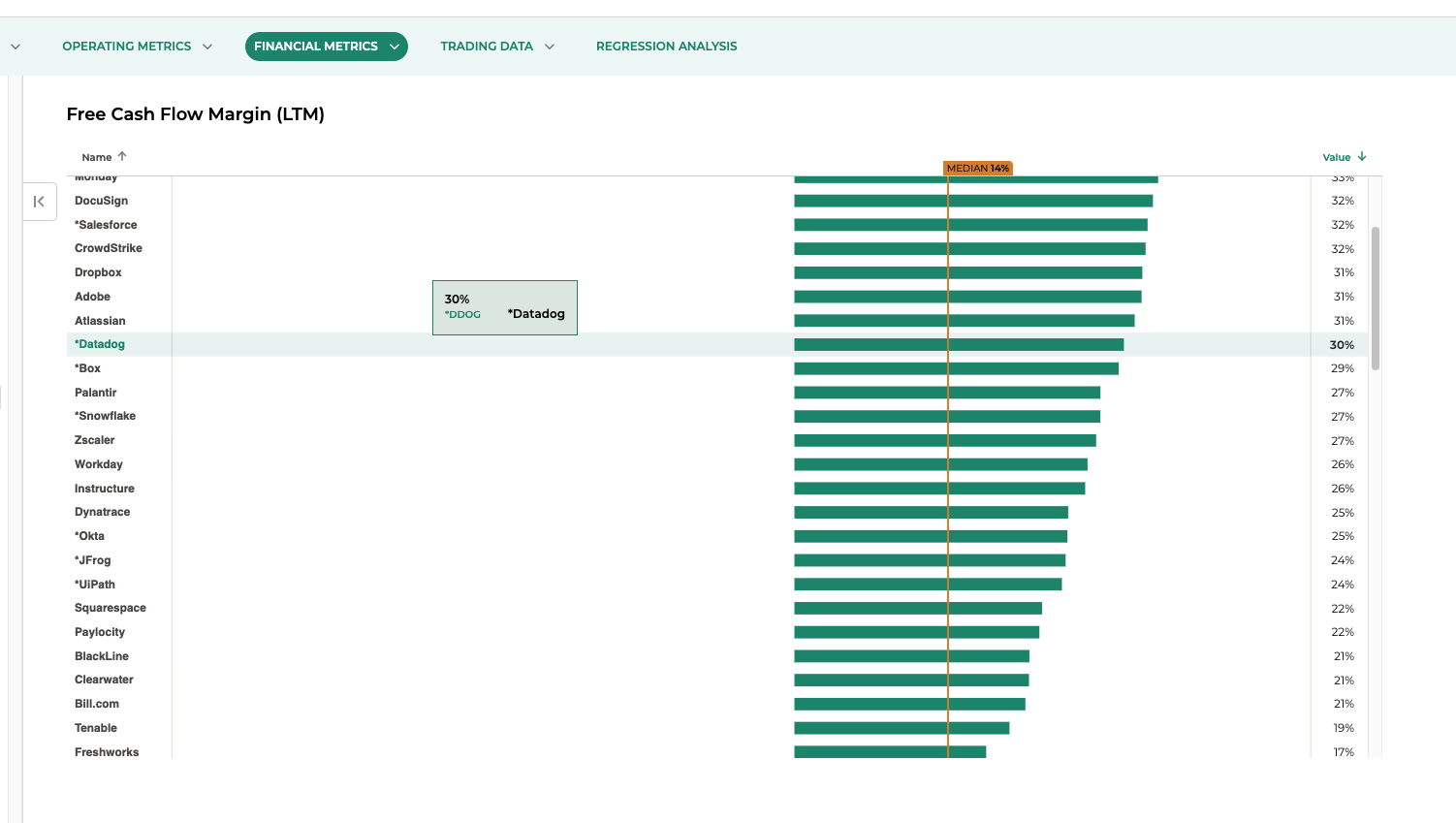

Free Cash Flow Margin(which isn’t the same as profitability but is an indicator of profitability) is ~30% so they’re likely pretty profitable

Approximate your company’s ARR

If you work at a company that is extremely transparent about its finances, fantastic! That’s a wonderful place to be. Dig up those numbers and scoot on down to do the valuation math!.

In all probability, you do not work at a place with highly transparent internal finances. That is normal and often preferable. If you know all of your company’s financial information, you are (congratulations!) a corporate insider. Corporate insiders have many rules surrounding when, how, and what they do with company equity in their possession. something something insider trading, manipulating the market.

That said, you probably have a feel for your company’s performance numbers. For example, as an engineer it’s generally pretty straightforward to determine the volume of events that your system is processing. Take that number, toddle on over to your public pricing page, and multiply those numbers together to get a feel for total revenue.

As the basic math says, (# of things sold) * (price of things sold) = total revenue.

This set of assumptions won’t reveal anything about profitability, but any cost of goods (CoGs) margin ratios sure will help. You also likely have a feel (just by existing at your company) for whether or not your company is profitable.

Take all those data points, treat them as privileged information, and use them to inform your back-of-the-napkin valuation calculations!

Do the valuation math!

Take the numbers you’ve identified:

- Choose a multiplier that seems safe to you. Look at the comps, what speaks to you?

- Multiply it by your company’s ARR

- Feel the insight washing over you!